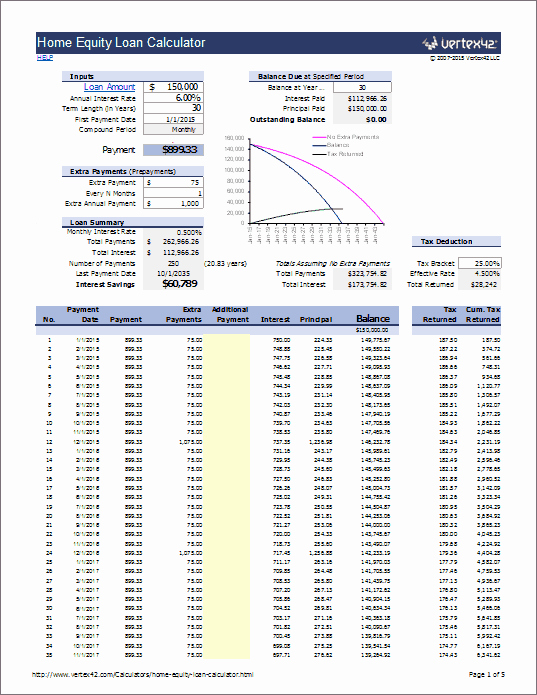

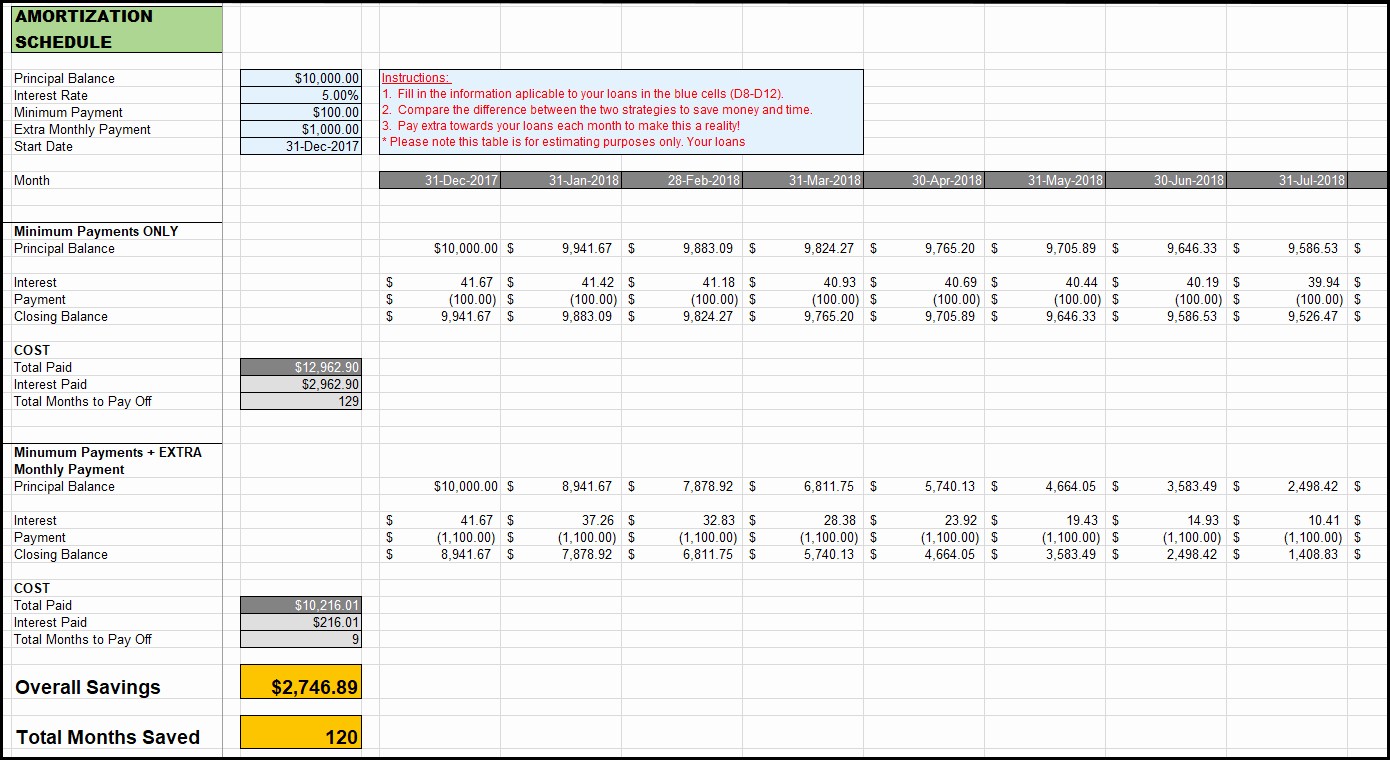

In this section, we will demonstrate 3 different examples to use early mortgage payoff calculator. Tax Deduction: Mortgage interest is tax deductible.ģ Examples of Using Early Mortgage Payoff Calculator in Excel.Interest Savings: If you make extra payments with your regular payments, you will save some interest.It totally depends on your lenders how you can pay your extra amount.

There are two types of Extra Payments: Regular Extra Payment and Irregular Extra Payment. After paying your monthly amount, whatever you pay is considered an extra payment. Extra Payment: Extra payment you want to pay every month.Say, your home loan APR is 6%, then the interest rate for a month will be 6%/12 = 5%. Annual Interest Rate (APR): Annual Interest Rate you will pay for your loan.For a mortgage loan, it is normally 15-30 Loan Terms: This is the total number of years you and the lender have agreed upon to pay off all the interest and loan.This includes the interest amount of the loan for a period (normally a month) and a portion of your principal amount. Regular Monthly Payment: This is the amount you will pay every month.Principal Amount: The original amount you took from a lender as the loan.Let’s first look at some critical definitions regarding Mortgage calculation.

0 kommentar(er)

0 kommentar(er)